When we launched Clean Energy Grades last spring, we wanted to give building owners and operators an easy-to-understand letter grade to assess the clean energy potential of a building. All that was needed (and is still needed) to get started with an evaluation is a building’s address. Using that address, Station A provides indicative estimates for the technical requirements and financial performance of various renewable energy options at a property.

.png?width=493&height=454&name=grade_27095e2ba69375c1d554d8b28dcaa236%20(2).png)

Over the last year of working with a diversity of buyers who’ve collectively listed, 49 MW in projects on the Station A Marketplace, we’ve learned a lot about what leads to a successful clean energy project. Along with the evolving economic conditions and the latest policy changes, we felt it was time to recalibrate our letter grades to better reflect the types of projects we see moving forward successfully.

🚀 Today we’re releasing an update to our grades

Here we cover the changes that we made to our grading methodology and the conditions that influenced them.

What changed?

- Placed greater weight on all cash financial viability vs. PPA availability.

- Added Internal Rate of Return (IRR) to project financial modeling.

- Upped the incentives to reflect the new Inflation Reduction Act (IRA) tax credit rates.

- Incorporated the latest build costs from WoodMackenzie Power & Renewables

- Adjusted grades in California based on the new NEM 3.0 export pricing.

🌦️ Market conditions that influenced the update

We’ve yet to see a project that doesn't pencil move to RFP

In this uncertain economic climate, financial viability is crucial for advancing a clean energy project forward. While financial viability looks different for each buyer, at a minimum, a project must pencil — or return more financial value over a project’s lifetime than the initial investment.

The IRA tax credit transferability

The passing of the Inflation Reduction Act (IRA) in August of last year not only increased the tax incentive to do a project but also the transferability of that tax credit, a value that wasn’t always realized. This means that an all-cash purchase of a renewable energy project has become a much more popular financing choice for property owners looking to maximize the financial return of their project (despite the initial upfront cost).

California’s NEM 3.0 decreased valuation of exported energy

The passing of California’s NEM 3.0 policy in most cases dramatically lowers the value of exported energy. While there is still an opportunity for a solid ROI through all-cash purchases, those that require 3rd party or PPA financing are going to see less economic incentive to deploy solar. But it also creates a new value stream and business case for adding energy storage to a solar project. We will be working toward future grade updates that include the effect of adding battery storage on cost and payback period.

Clean energy is making sense in more places

Clean energy is no longer reserved for states with progressive policies like CA, IL, MA and NY. Increasingly this year, the Station A Marketplace has facilitated projects in traditionally climate-unfriendly places like TX and LA. We’ve witnessed that policies can and do help more projects pencil, but they are not required for a clean energy project to produce a compelling financial return.

🪄 Introducing Clean Energy Grades 2.0

This next evolution in our grades simplifies the picture for property owners looking to decarbonize their sites based on financial viability.

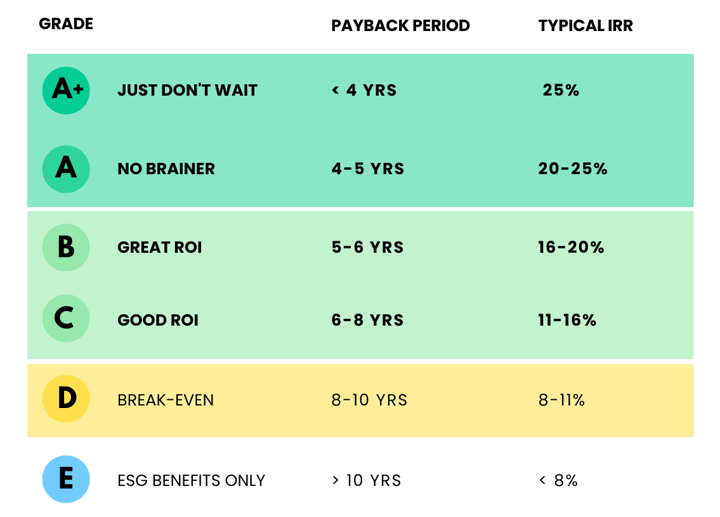

Our new grades are pegged to a project’s simple payback period, or the estimated time it will take for a solar project to recoup its initial investment. These payback periods typically correspond to internal rates of return (IRR). An A+ that pays back in less than 4 years, typically correlates with an IRR that is greater than 25%.

In states where Power Purchase Agreements (PPAs) are available, the grades also indicate the financial viability of a PPA because typically PPA rates are well-correlated to the all-cash financials of the financier.

In the future, we want our grading system to be responsive to the changes in the market, from interest rates to build costs, so we anticipate revisiting this view every year and making adjustments to stay in line with how buyers see the opportunities around them. If you have any feedback on our grades and methodology please feel free to let us know at grades@stationa.com.

🛣️ How to take action

1. Submit your portfolio of buildings to be graded

All you need is a list of addresses and if you are a qualified buyer, the initial portfolio evaluation is free. If you only want to check out one address, get a free location report card here. If you already have a portfolio with us, you can log back into your Station A account and see your data automatically refreshed with the latest market conditions.

2. Determine your minimum IRR (aka hurdle rate) or payback period

Calibrate your internal investment requirements to how they map to our simple grading system. For example, if your hurdle rate is 12% you will want to look at doing a project at locations with a grade of C or better.

3. If you’re ready to further qualify a project, reach out to our team

We can help you further refine a building’s financial picture by ingesting your actual data like the cost of energy and historical usage. We can also walk you through other typical steps to assess the physical building for a project e.g. roof conditions and electrical set-up. You can reach out to us anytime.