If your company has ambitious sustainability goals or is looking to stabilize or cut down energy costs, you're likely considering a Power Purchase Agreement (PPA).

A power purchase agreement allows a business to receive stable and often lower-cost renewable electricity with no upfront costs (source: energy.gov).

In this video interview, Station A's Richard Ling interviews Dan Holloway, VP of Origination & Acquisitions at Sustainable Capital Finance to unpack all the considerations clean energy buyers should take into account when looking at PPAs and other solar financing options. Dan has helped finance over 150 megawatts of commercial and industrial solar projects with his team at SCF.

👀 Watch the interview

🎧 Listen here

💬 What we cover

| Time | Topic |

| 2:00 | What are some options for financing a commercial clean energy project? |

| 4:45 | How do PPAs stack up against other financing options? |

| 8:45 | How does a PPA agreement look in practice? |

| 12:15 | Which businesses qualify for a PPA? |

| 16:30 | How do PPA providers make money from PPAs? |

| 18:35 | How are current tax policies impacting PPAs? |

| 21:10 | What factors make a PPA pencil? |

| 25:15 | How do PPA providers approach pricing an agreement? |

| 27:20 | Key differentiators to look for in solar developers |

| 30:30 | What are some PPA "gotchas" to look out for? |

| 34:00 | How are current market conditions affecting solar financing? |

🪄 Find out if your building is eligible for a PPA

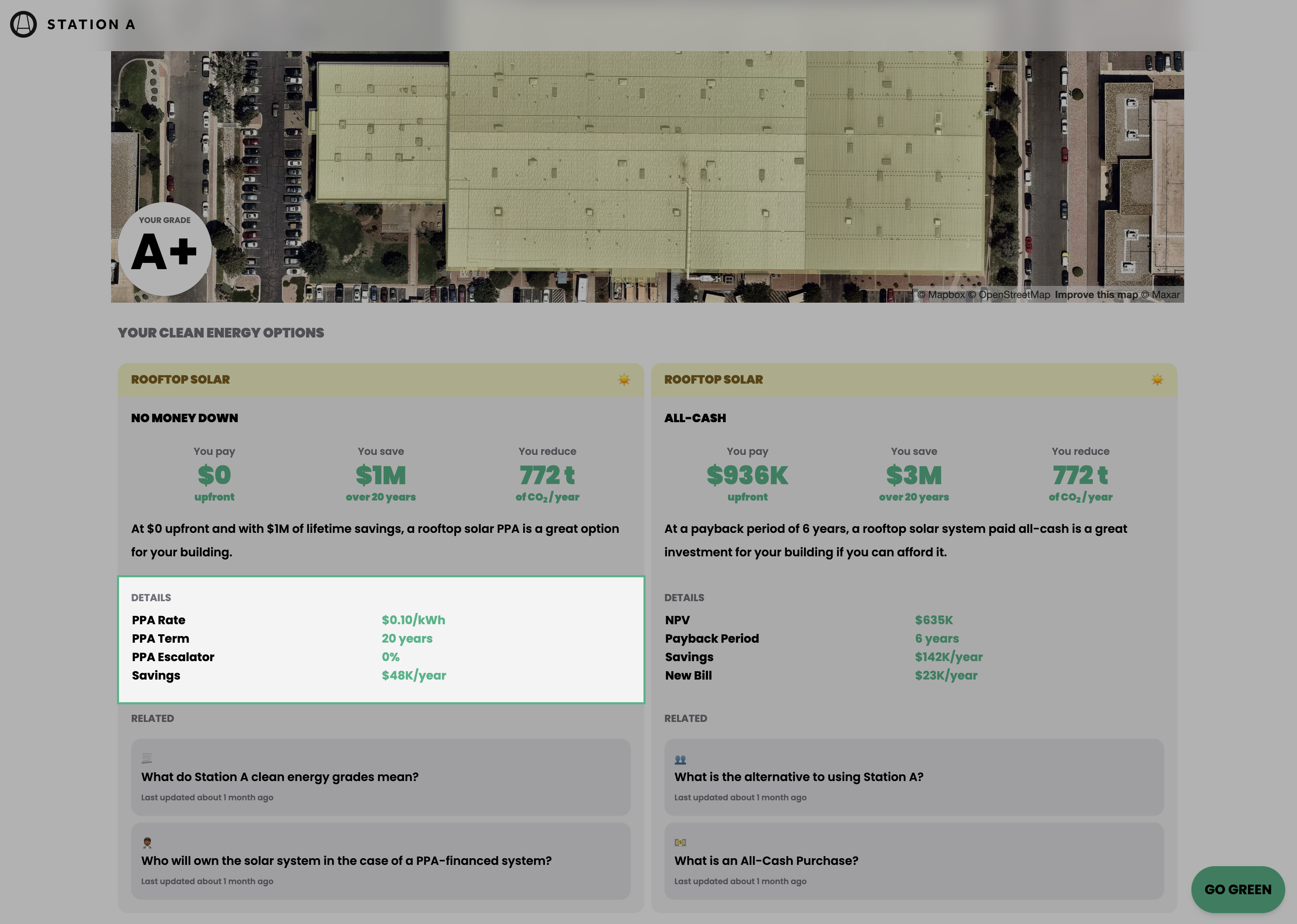

Enter an address on stationa.com to view a building’s Clean Energy Grade. Your building’s grade will include an analysis of the clean energy options available to you as well as financing options to support them. Tap the “GO GREEN” button to receive your clean energy buyer’s guide with information about how to take the next step in sourcing your clean energy solution.